ISA Transfers

Move your ISA to Family Building Society - find out the different ways to transfer your ISA and the options that are available to you

Already have an ISA elsewhere? You can transfer it to Family Building Society without losing your tax-free benefits. Whether you’re a new customer or already have an existing ISA with us, we can guide you through the process.

How to transfer your ISA

FAQs

Charges

Have a fixed rate cash ISA?

Transfers In

- We do not charge fees for transferring funds into a Family Building Society ISA, but your current provider may charge if you break a notice period or fixed term.

Transfers Out

- Notice ISAs – If you transfer out without giving the required notice, we will deduct daily interest equivalent to the length of the notice period

- Fixed rate cash ISAs – If you transfer out before the end of your fixed term, Early Access Charges will apply. Please see the section 'Have a fixed rate cash ISA?' for more information.

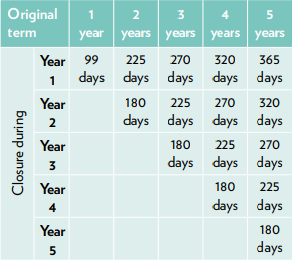

Early access charge depends on the term you originally chose and how much time is left when you close your account. The closer you are to the end of the term, the lower the charge (as shown in the table below). We work out the charge using your closing balance and the interest rate at the time you close the account.

For example, if you chose a two-year fixed term and close your account during the second year, the charge would be equal to 180 days’ interest at the rate that applies at that time.

Please note: If the Early Access Charge is greater than the interest earned at the point of closure, some of the capital invested could be lost.

For full details please refer to the 'Taking Money Out' section of the ISA Product Features leaflet.

Withdrawals

- Notice ISAs - Withdrawals are available without an access charge when the required notice period has been served. Alternatively, you may withdraw without giving notice, subject to the loss of interest equivalent to the notice period on the total amount withdrawn. For more information on how to withdraw from a Notice ISA, please see the 'Taking Money Out' section of the Product Features leaflet

- Fixed rate cash ISAs - Withdrawals are not permitted prior to maturity of the fixed rate term; however, the account can be closed before maturity subject to Early Access Charges. Please see the section 'Have a fixed rate cash ISA?' for more information.

Help & Support

If you have any questions, our friendly Family Service Team are here to help. Call us on 03330 140144, email savings.service@familybsoc.co.uk or send us a secure message via the Online Service.