-

Online Service update. Due to planned essential maintenance, our Online Service will be unavailable from 10pm on Thursday 5 March to 2am on Friday 6 March. We apologise for any inconvenience this may cause.

-

Mortgage customers - We’ve launched a new Interest‑Only Expat Buy to Let 2 Year Fixed Rate product specifically designed to increase borrowing potential.With a rate of 4.69% up to 75% LTV, and available for both purchase and remortgage applications, it benefits from our recent Buy to Let affordability enhancements to make all our 2 Year Fixed Rate product options more competitive to landlords. Additionally, this product offers a £500 cashback for remortgage applications. Discover how much you could borrow here.

-

We're pleased to announce the launch of our Family Mortgage. Find out more.

Family members can help support buyers by providing security for their mortgage, without gifting money.

Borrow 100% of the property value with no deposit with the Family Mortgage.

-

Savings customers - we have increased the interest rates on our Fixed Rate Bond and Fixed Rate ISAs. Find out more

The interest rates on our 1 Year, 2 Year and 3 Year Fixed Rate Bond and Fixed Rate ISA products have increased from 12 February 2026.

Frequently asked questions about our savings products

Have a question about your savings account? Here we have answered some of our most frequently asked questions.

If you need our help, please contact our friendly Family Service Team.

General

As part of the account opening process, we run an electronic identity check. Sometimes we’re unable to verify your details, but don’t worry as this can happen for a number of reasons.

Please do not try to pay into your new account until we’ve been able to complete our identity checks as any money you send will be returned to you.

If we require additional documents, we’ll either email you or send you a secure message, explaining what documents we need. This will also be confirmed on the screen after your application takes place. For reference, the documents that may be required are below.

Confirming your nominated bank account

To confirm your nominated bank account you will need to provide us with one of the below:

- An original bank or building society statement or an electronic statement downloaded from your banking online facility which shows your latest transactions dated within the last three months and displays all of the following:

- full name

- sort code

- account number - A cheque marked ‘cancelled’ and crossed through

- A paying in slip from a paying in book

If your bank or building society statement does not show your address - please also send us one of the following:

- Utility bill (dated within the last three months)

- Local authority tax bill

- Formal court document (eg Judgement or Order, Grant of Probate)

- Letter confirming your residency at a nursing home on their headed paper1.

Please note that due to security, we cannot accept proof of identification via email.

1These must be original documents and sent to us by post, (we cannot accept copies via the Online Service or our Secure Document Upload facility). These will be securely destroyed rather than returned to you.

Confirming your identity

To confirm your identity, we require one of the following government issued documents:

- Valid, signed and in date passport*

- Valid, in date UK photo card or old style paper driving licence*

- Recent evidence of entitlement to a state or local authority benefit (e.g. state pension, tax credit or housing benefit)

- Firearms certificate or shotgun licence*

- HMRC tax notification (excluding self-assessment documents).

* For your own protection, we advise not to send original documents through the post and recommend sending certified photocopies. All documents received will be sent back to your home address when your identity has been confirmed. You can find our more about certifying your documents.

How to upload and send us your documents

You can:

- Upload your bank or building society statement by logging in to the Online Service and visiting the 'Account overview' page

- Upload your bank or building society statement via our secure document upload facility on our website and select 'Customer Service - Savings'

- Post2 them to: Family Building Society, Ebbisham House, 30 Church Street, Epsom, Surrey KT17 4NL

- Bring any documents to our Epsom branch:

Family Building Society, Ashley Square, Epsom, Surrey, KT18 5DD.

Please note that due to security, we cannot accept proof of

identification via email.

2For your protection, we advise against sending original identity

documents through the post. All documents received in the post will be sent

back to your home address when your identity has been confirmed.

Please note, we are only able to accept banks and building societies that are regulated by the Prudential Regulation Authority (PRA). To find out more about which banks and building societies are regulated.

What happens next?

Once we've successfully verified the identity of all account holders, you can add funds to your account. We will contact you by secure message to confirm you can do this.

Further details can be found on the ‘Add or withdraw money’ section. To access this, please click on your new account after you log in to the Online Service.

Online Service

Managing my account

You can view the interest rate of your account when you log in to our Online Service. Alternatively, you can check our website, call us on 03330 140144, come into our Epsom branch or request this in a signed letter.

If you're registered for our Online Service:

The quickest, safest and most convenient way to update your email address is via our Online Service. Once you have logged in go to 'Update my profile' to update your contact details.

If you contact us by telephone, secure message or written request, we may advise you to update your email address via our Online Service to ensure that your details are up to date on all platforms.

PLEASE NOTE If you are moving overseas, please contact us as we may need to close your account(s). If your occupation means that you are still a UK resident for tax purposes (for example if you are in the armed forces or you are a crown employee), we need to be aware of this. You can use the contact methods shown above to let us know.

Other ways to update your details:

Alternatively, to update your contact details including your home address you can call us on 03330 140144 and tell us on the phone after security tests have been passed, visit us in our Epsom branch, provide details in a signed letter, or you can fill in and post back our Change of Address form.

You will need to complete a Transfer of Ownership form and an Additional Account Holder form and post them to us. You can also call us on 03330 140144 to request these forms.

Yes, you can send us an online secure message, call us on 03330 140144, visit our Epsom branch or request in a signed letter.

Personal savings accounts

If your account is an instant access personal savings account, depending on the terms of the account, this can be closed online. When logging into the Online Service, this is done by selecting your account, then ‘Manage account’, where you will then find the 'Close account' option. Follow the steps through to close this to your nominated bank account or another account held with the Society.

ISA’s, Offset Savers, Fixed Term and Notice accounts

ISA’s, Offset Savers, Fixed Term and Notice accounts cannot currently be closed online. To do this, please send us a secure message, write to us or call us.

Closure requests

Closure requests for instant access accounts need to be received before 3pm for closure the same day, otherwise the account will be closed the next working day.

Where a daily withdrawal limit applies to your account, amounts in excess of the limit must be split into a series of withdrawals over a number of days prior to closure of your account.

If your account has a daily withdrawal limit, you will need to ensure the closing balance is below the limit amount, including any interest accrued. This amount will be displayed to you, prior to the closure of the account.

Funding my account

Each Family Building Society savings account may have different options for paying in. Please refer to your savings product account terms and conditions.

1. Debit card

To add money to your savings account by debit card you must be registered for our Online Service.

If you opened your savings account online, registration is part of the account opening process and you can add by debit card straight away. Once logged in to the Online Service you'll be able to do this from the 'Savings account summary' page. Simply click on 'Add or withdraw money' money, select 'add money' and confirm your payment details.

If you are not already a user our Online Service , you can register here.

2. Bank transfer

To add money to your savings account by bank transfer you must be registered for our Online Service.

Once logged in to the Online Service you'll be able to do this from the 'Savings account summary' page. Simply click on 'Add or withdraw money' money, select 'add money' and select 'See details of how to make a bank transfer to us'.

When you’re setting up a new payment or amending an existing payment, the Payee Details are checked through Confirmation of Payee (CoP). So, when you send money electronically to your savings or mortgage account with Family Building Society it’s important that you include the following account details:

Payee: Account holder’s full name

Payee's bank sort code: 40-02-50

Payee's bank account number: 21397400

Payee's reference: Your 10-digit Family Building Society account number

Payee's account type: Personal (unless your account with us is for a Business or Charity, then please select ‘Business’)

Important information

- You can find your Family Building Society account number on your Savings Account Certificate when you originally opened your account. Alternatively, if you're registered for our Online Service, your account number will be shown on the main screen after you've logged in

- The payment details may show up as HSBC, as we use them for our banking services.

3. Cheque

You can make payment by cheque payable to Family Building Society, followed by your 10 digit savings account number.

Please post to FREEPOST, FAMILY BUILDING SOCIETY or visit our Epsom branch.

4. Cash

You can visit our Epsom branch to pay cash into your savings account.

Making withdrawals

If your savings account allows withdrawals, and you are registered for our Online Service, you can request a withdrawal online.

Once logged into the Online Service you'll be able to do this from the 'Savings account summary' page.

- Go to your account and click 'Add or withdraw money'

- Select 'Withdraw money', select the account you'd like to move your money to and enter the amount you'd like to withdraw

- Once your withdrawal request has been submitted you will see a 'Success' page with details of when you should expect to see funds in your chosen account.

If your account can only be operated online, you will need to action this request via our Online Service.

Alternatively, if your account allows withdrawals, you can either send us a secure message using our Online Service, call us on 03330 140144, visit our branch or post a signed letter.

Branch Saver

A withdrawal request from a Branch Saver account must be made in person at our Epsom branch. Please note that some of our accounts are subject to maximum daily withdrawal limits.

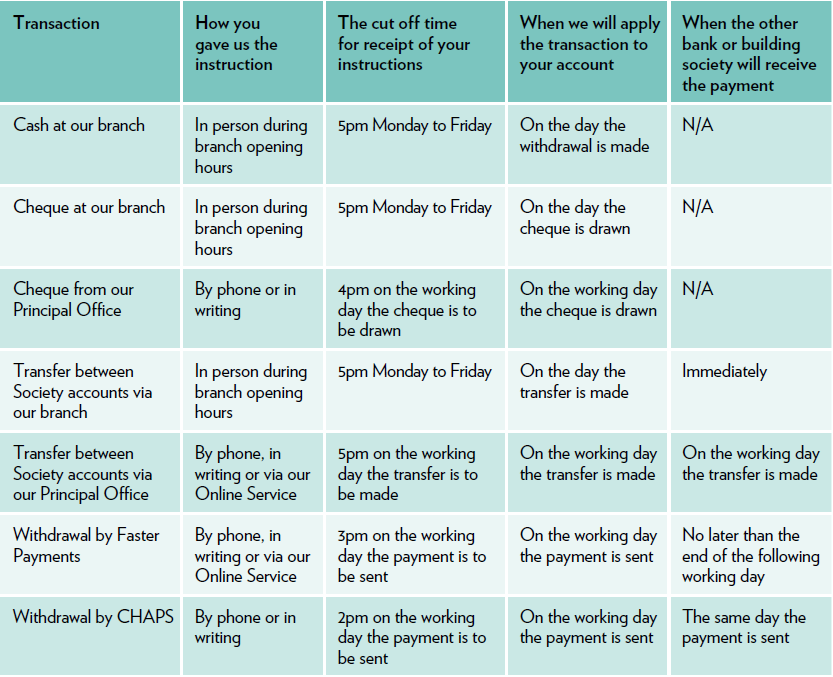

Our cut off time for processing payments is 3pm (on working days).

If you request a withdrawal before 3pm, it will be sent the same day and will reach your account no later than the end of the following working day.

If you request the withdrawal after 3pm, it will be sent the next working day and will reach you no later than the end of the working day after. For example, a withdrawal requested at 4pm on Monday will be sent by us on Tuesday and reach your account by no later than the end of the day Wednesday.

Interest is paid on money withdrawn from your account up to but not including the working day of the withdrawal.

You can send us an online secure message, call us on 03330 140144 or send us a signed letter.

You will need to provide details of a valid UK bank/building society account. Please note, we are only able to accept banks and building societies that are regulated by the Prudential Regulation Authority (PRA). Find out more about which banks and building societies are PRA regulated.

Verifying your nominated account details

We will need to verify your nominated account details and, wherever possible, we will carry out an electronic check. If we can’t verify your nominated account details electronically, we will need additional documentation, along with a signed letter from you requesting the change.

We will need one of the following documents:

- An original statement sent from your bank or building society dated within the last three months

- A cheque marked ‘cancelled’ and crossed through

- A printed paying-in slip

- A downloaded PDF online bank or building society statement showing your latest transactions.

If you're sending a PDF online statement, you'll need to upload this via the secure document upload facility on our website. Alternatively you can upload via our Online Service and can click the 'Upload' button on your online account.

You can also upload a photograph or scan of a certified copy of your original bank statement to your online account or via the secure document upload facility on our website.

If you are sending us a cancelled cheque or paying in slip, we are unable to accept photographs or scans of these. Please send these to us by post.

If you choose to send your documents via post, original statements will be returned to you, and we will securely destroy cancelled cheques or paying-in slips.

Bonds

Your Fixed Rate Bond becomes available for reinvestment or withdrawal on the maturity date shown on your Certificate (or the next working day if maturity falls on a weekend or Bank Holiday). We will write to you no later than 15 calendar days before maturity with details of the default and alternative products available for reinvestment.

Yes – you will need to confirm your request by either calling us (would add phone number here) or returning the bond maturity instruction form.

Yes, but only within 15 days of your bond maturity date.

Yes, as long as the account is available when your Bond matures. You will need to apply for the new savings account either online or via postal application form (depending on the terms of the new account).

If you do not give us instructions before your maturity date, you will have 30 days following reinvestment in order to cancel or change your mind. If you do give us an instruction, and subsequently change your mind after maturity, then you will have 15 days.

Yes. You will need to let us know when you give us your Bond maturity instructions.

Windfall Bond

For all questions relating to our Windfall Bond account please refer to our Windfall Bond FAQs.

ISAs

Yes, but we only allow subscriptions to be made into one Cash ISA with us per tax year.

No, transfers from Stocks & Shares ISAs are not permitted.

You can only transfer a Cash ISA into one of our ISA products. We only allow full transfers in for current tax year subscriptions. We do not allow partial transfers of current tax year subscriptions however, partial transfers in of previous years' subscriptions are allowed.

To switch providers, you will need to contact the ISA provider you wish to move your funds to and fill out their ISA transfer form in order to move your account. They will then send it to us to initiate the ISA transfer.

What happens to my ISA savings when I die?

When you die your spouse or civil partner can inherit your ISA savings and keep them with a tax-free status.

The value of your ISA(s) will be calculated from the day you die. Your spouse or civil partner can apply to inherit your savings in the form of an allowance, which is also called an ‘Additional Permitted Subscription’ or APS allowance. Your spouse or civil partner’s own individual ISA allowance (£20,000 for 2025/26 tax year) will be unaffected.

For deaths on or before 5 April 2018, the APS is limited to the value of their deceased partner’s ISA at their date of death. For deaths on or after 6 April 2018, it can be the total value of the ISA up to closure.

You don’t have to leave your spouse or civil partner your money in your will for them to benefit from the APS allowance. Instead, you could leave the savings you’ve built up to someone else in your Will, for example, one of your children, and your spouse or civil partner will still be able to apply for APS allowance. Their APS allowance would be up to the value of your ISA, although your spouse or civil partner would need to use their own money to save into it.

If you have inherited your spouse or civil partner’s ISA(s), the APS allowance is only allowed if they died on or after 3 December 2014.

How long is the Additional Permitted Subscription (APS) allowance available for?

The APS allowance is available for three years after the date of death, or for up to 180 days after administration of the estate is complete, whichever is the latter. This is known as the ‘permitted period’. If your spouse or civil partner died between 3 December 2014 and 5 April 2015, the three years is counted from 6 April 2015.

How can I transfer my Additional Permitted Subscription (APS) allowance from you to another provider?

A transfer authority form is required from the other provider completed by the surviving spouse or civil partner together with the Grant of Probate (if available) and identification.

Alternatively, on receipt of the Probate documents and closure/transfer

form from the Executors, the full balance of the ISA(s) can be sent to the surviving spouse or civil partner who can then apply to place their APS allowance with the other provider.

My spouse had an ISA(s) with another provider. How can I transfer my Additional Permitted Subscription (APS) allowance to you?

A request can be made directly to the other provider.

We will need signed instructions from the Executors or the surviving spouse or civil partner, together with the funds, the Grant of Probate (if available) and a letter from the provider stating the ISA balance at the date of death. We will then transfer

the APS allowance to an existing or new account with us.

Alternatively, a Deceased Transfer Authority Form can be requested from us and completed by the surviving spouse or civil partner in order for us to request the transfer of the funds

from the other provider.

Can my spouse or civil partner transfer the ISA to an existing or new account within Family Building Society?

Yes. We would require the Grant of Probate or the witnessed Statutory Declaration together with identification from the Executors if they are not already known to us.

If the surviving spouse or civil partner is an existing customer, we can accept a written and signed declaration covering the following points:

- A formal request to transfer the funds to their ISA with the Society.

- A declaration that they are the surviving spouse or civil partner.

- Confirmation of the date of marriage or civil partnership.

- Confirmation that they resided at the same address as the deceased upon the death of their spouse or civil partner.

- Confirmation that they were not separated.

Alternatively, a Deceased Transfer Authority form can be requested and completed by the surviving spouse or civil partner together with identification and Probate documents.

If a new ISA is required to transfer the APS allowance, an application form will need to be completed by the surviving spouse or civil partner and sent to us with the requested Probate documents and identification.

If you have any questions please contact our friendly service team on 03330 140144

Does my spouse or civil partner have to use all or any of the Additional Permitted Subscription (APS) allowance?

Your surviving spouse or civil partner is under no obligation to use all or any of the APS allowance, but they must make an APS application to their chosen ISA manager during the ‘permitted period’ otherwise the allowance will be lost.

How can I ensure my spouse or civil partner gets the Additional Permitted Subscription (APS) allowance?

We require a Grant of Probate if the total amount in the ISA is £15,000 or more. An appropriate Statutory Declaration can be drawn up if the total amount in the ISA is less than £15,000 in order to release the funds for the transfer to take place.

I am a long-term partner but we are not married or in a civil partnership. Is my spouse or civil partner still entitled to the Additional Permitted Subscription (APS) allowance?

No. HMRC has expressly stated that the new rules apply only to the formalised relationships of marriage or civil partnership.