-

Online Service update. Due to planned essential maintenance, our Online Service will be unavailable from 10pm on Thursday 5 March to 2am on Friday 6 March. We apologise for any inconvenience this may cause.

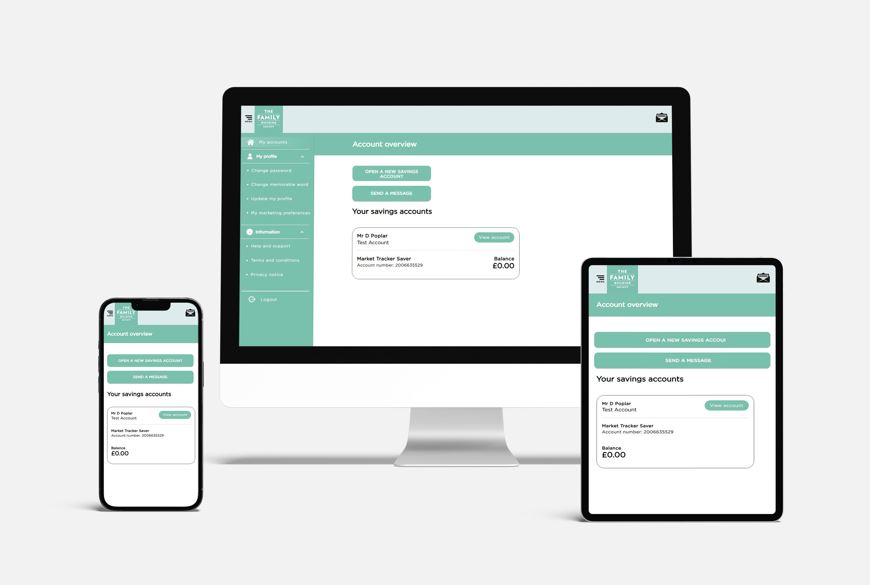

What are the benefits of using our Online Service?

Safe and secure

- Two-factor authentication each time you log in

- Send and receive secure messages with our Customer Services Team

- Keep your personal details up to date.

Savings

- Check balances and view your latest transactions

- Make withdrawals to your pre-nominated bank account

- Make transfers between your Family Building Society accounts

- View, save and print your annual ISA and savings accounts statement(s) online

- Set up a savings goal for your savings account (if your account allows)

- Apply online for a range of savings accounts

- Close your account online (depending on the terms and conditions of your account)

Mortgages

- Check your mortgage balance and latest transactions

- View, save and print your mortgage statement online

Please note if you are acting as a Power of Attorney then you will be unable to open an account online. For further information please read our Online Service terms and conditions below.

Due to improved security, you must have a unique email address for your Online Service account. If you currently share an email address with another customer, a different email address will need to be used to register or transfer each Online Service account on our upgraded system.

Online Service Guide

Our handy guide provides useful information on how to operate your account online.

Helpful information

Online Support Team

If you need help with our Online Service, please call our dedicated Online Support Team.