How does the Windfall Bond work?

Please note: the Windfall Bond account is available for new account openings

All our savings accounts are FSCS protected.

How does the Windfall Bond work?

Each Windfall Bond needs an investment of £10,000, and you can have as many bonds as you like (subject to availability).

Once opened, the Windfall Bond pays a rate of interest linked to the Bank of England Bank Rate minus 1%.

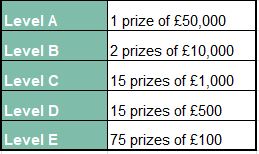

We will notify winners of the Monthly Free Prize Draw within 10 working days of the draw taking place.

Further information can also be found in our Product Features leaflet.

We reserve the right to change the terms of the draw, the prizes available or end the monthly free draw after giving seventy calendar days’ notice, or as per clause 27 in our Prize Draw Rules which are also included in our Product Features leaflet

If you have any questions about the Windfall Bond, please contact our New Business Team:

£10,000 Windfall Bond Winner - Case Study

After researching investment options, Mrs. Rushworth chose Family Building Society for its competitive rates. Over the years, she invested in various products and eventually won one of our major prizes!

Product details

Apply for a Windfall Bond and earn 2.75% annual interest (Gross AER)

Frequently asked questions

Answers to the most common questions asked by our members about the Windfall Bond.