Financial Wellbeing survey - the results

Over recent years, we've surveyed our Members to gather views on financial wellbeing and the UK economy, as well as other housing issues. The key findings of our Autumn survey are summarised below.

A summary of results from our latest Financial Wellbeing survey

4,276 Members completed our Autumn 2025 survey, taking place just before the Autumn budget – a big thank you to everyone who took part! This represents a 61% increase in responses compared to the Spring survey.

What does the term 'financial wellbeing' mean to you?

The overall feeling was positive, with 70% of respondents feeling “happy” or “very happy” about their financial wellbeing. 25% were neutral and 6% expressed unhappiness.

Members' definitions of 'financial wellbeing' centred around:

Security and control: “Financial security” and “spending management” (13% each)

Stress and hardship: 12% mention financial stress, and 9% quoted ‘emergency buffers’

Day to day: Bill payments, essential needs, and comfortable living are recurring themes

Longer term planning: under 5% mentioned future planning.

Thoughts on the economy and personal finances

Members were quite pessimistic about the economy over the next six months with:

56% expecting a slowdown in the economy

Only 5% foreseeing growth.

However, they thought their own financial outlook was more stable with:

58% expecting their situation to remain the same

35% expecting it to worsen.

What are the biggest threats to financial wellbeing?

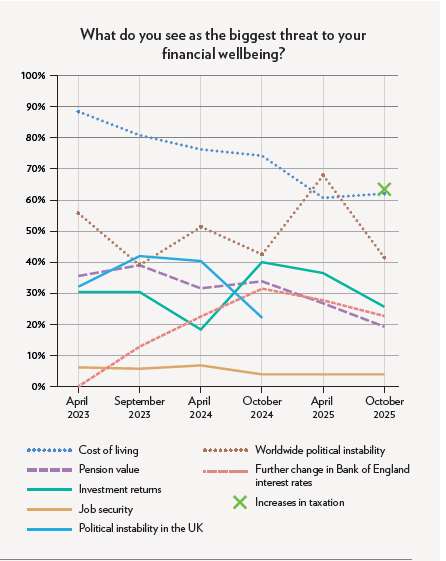

The biggest threat to respondents’ financial wellbeing was the rising cost of living and tax increases, with political instability and weaker investment returns following closely behind (as seen in the illustrated graph to the right).

Policy and government sentiment

Members expressed strong concern about government borrowing, with 74% holding negative views. Confidence in the upcoming budget was low, with 59% expecting negative outcomes.

Speculation around ISA and pension changes had already impacted 26% of respondents’ financial planning.

On the pensions triple lock:

49% said it’s 'essential'

23% supported it with future adjustments

Only 19% opposed it outright.

How can lenders reach Net Zero?

It was great to hear your thoughts on what lenders should do to support Net Zero goals. The most popular suggestions were implementing green incentives (45%), reducing energy usage (44%), and switching to renewable energy (42%). Interestingly, 17% of Members felt lenders shouldn’t take action, a view that has remained largely unchanged since our Spring 2025 survey.

Family and intergenerational support

Financial support within families is common:

41% had helped a family member financially

17% knew of older relatives who had received help from children.

Concern for younger generations is evident:

37% believed their children or grandchildren felt pessimistic about their financial future

Only 4% thought they were optimistic.

Your feedback really helps

We’ll continue to run the survey at regular intervals over the coming years to allow us to track your views, financial resilience, and that of your family and to identify any emerging trends. The insight gained will help us to inform key stakeholders and the wider personal finance industry of our your views.