Notices

-

Online Service update. Due to planned essential maintenance, our Online Service will be unavailable from 10pm on Thursday 5 March to 2am on Friday 6 March. We apologise for any inconvenience this may cause.

Your quarterly Market Tracker account rate review - interest rate reductions

Your Market Tracker account is designed to give you the peace of mind that you’re always receiving a competitive interest rate. As we review the rates available from our reference group four times a year, you don’t have the hassle of checking the market and regularly moving your money about.

Our Market Tracker accounts offer the average interest rate paid on the top 20 easy access accounts across the market from our 'reference group’.

Since the last review of our Market Tracker accounts in December, interest rates across the market have reduced by an average of 0.07% over our ‘reference group'.

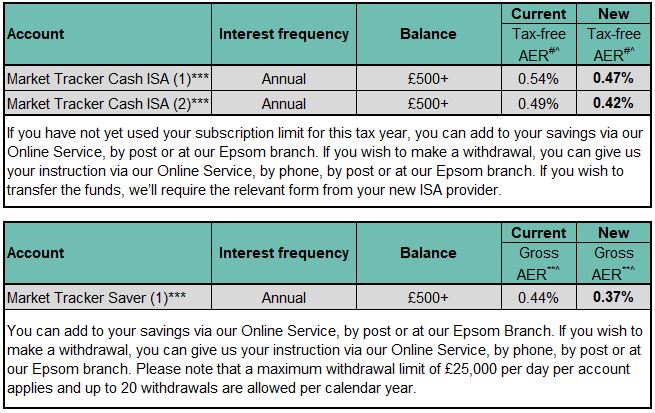

Unfortunately this means our Market Tracker interest rates will also decrease by 0.07% from 1 April 2021, which is reflected in the table below.

We know this decrease is disappointing - savings interest rates continue to be low across the market in general since the Bank of England reduced the Bank Rate to 0.10% on 19 March 2020.

Our Market Tracker accounts offer the average interest rate paid on the top 20 easy access accounts across the market from our 'reference group’.

Since the last review of our Market Tracker accounts in December, interest rates across the market have reduced by an average of 0.07% over our ‘reference group'.

Unfortunately this means our Market Tracker interest rates will also decrease by 0.07% from 1 April 2021, which is reflected in the table below.

We know this decrease is disappointing - savings interest rates continue to be low across the market in general since the Bank of England reduced the Bank Rate to 0.10% on 19 March 2020.

The new rates effective from 1 April 2021 are as follows:

*** No longer available to new business.** Interest is paid gross without deduction of income tax. You will need to declare any income from savings interest earned over your Personal Savings Allowance through a self-assessment tax return to HM Revenue & Customs. Interest is paid annually and available from the following day.# Interest is paid tax-free as it is currently exempt from Income Tax. The future tax treatment of Individual Savings Accounts may vary.^AER stands for Annual Equivalent Rate and illustrates what the annual rate would be if interest was compounded.

If you feel that your market tracker is no longer meeting your savings needs, we have other comparable products available if you wish to move your money. If you would like to see details of all our savings accounts, please visit our website familybuildingsociety.co.uk/Savings

Alternatively, you do of course have the option to move to an alternative provider. Although we’d be sorry to see you go, we will help you do this should you wish to transfer your money elsewhere.

*** No longer available to new business.** Interest is paid gross without deduction of income tax. You will need to declare any income from savings interest earned over your Personal Savings Allowance through a self-assessment tax return to HM Revenue & Customs. Interest is paid annually and available from the following day.# Interest is paid tax-free as it is currently exempt from Income Tax. The future tax treatment of Individual Savings Accounts may vary.^AER stands for Annual Equivalent Rate and illustrates what the annual rate would be if interest was compounded.

Next steps

If you’re happy that your savings account still meets your savings needs, you don’t need to do anything.If you feel that your market tracker is no longer meeting your savings needs, we have other comparable products available if you wish to move your money. If you would like to see details of all our savings accounts, please visit our website familybuildingsociety.co.uk/Savings

Alternatively, you do of course have the option to move to an alternative provider. Although we’d be sorry to see you go, we will help you do this should you wish to transfer your money elsewhere.

Our reference group is changing

As part of the terms of the Market Tracker account, we review our reference group once a year. We'll be changing the firms we include in the group and this will take place before the next quarterly rate change effective from 1 July 2021. We'll publish the details on our website in April. You can find out more about our reference group by visiting familybuildingsociety.co.uk/ref

If you have any questions about our Market Tracker account or anything else, please contact our Family Service Team on 03330 140144* or email savings.service@familybsoc.co.uk

* Our phone lines are open Monday – Friday, between 9am and 5.30pm, and closed on Saturday. We may record any phone calls we have with you in the interest of staff training, monitoring customer service or for security purposes.