-

Online Service update. Due to planned essential maintenance, our Online Service will be unavailable from 10pm on Thursday 5 March to 2am on Friday 6 March. We apologise for any inconvenience this may cause.

The Family Mortgage

Helping buyers with little or no deposit to purchase a home with family support.

We can lend up to 100% of the property value.

The mortgage will be secured on your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

A mortgage built around family

For many, saving for a deposit has become increasingly challenging and whilst family members are willing to provide financial support, they need to consider their own finances.

This is where the Family Mortgage can help....

Our 100% LTV Family Mortgage has been designed to help families support your mortgage by using security in the form of their savings and/or equity in their property, reducing or even replacing the need for a deposit.

Flexible family lending for first-time buyers or growing families.

How it works for home buyers

Fixed monthly payments

We offer a five year fixed rate Family Mortgage giving you the security and certainty of what you need to pay every month.

You don't need a deposit - family security can replace all or part of the deposit as security for your mortgage.

Borrow up to 100% of the property value

Family members can provide security for your mortgage using their savings and/or property, without giving you any money.

Family security (plus any deposit) must total 20% of the property value.

You own your property

No matter who has helped you by providing security for your mortgage, you have the legal rights to the property.

After five years

You'll usually move onto a standard mortgage product and as long as the mortgage payments have been kept up to date, family members security will be released back to them.

How it works for family members

Who can provide security for the mortgage

Support can be given by the homebuyer's:

- Parents

- Grandparents

- Siblings

- Aunts and uncles (siblings of parents)

- Step-relations in these roles

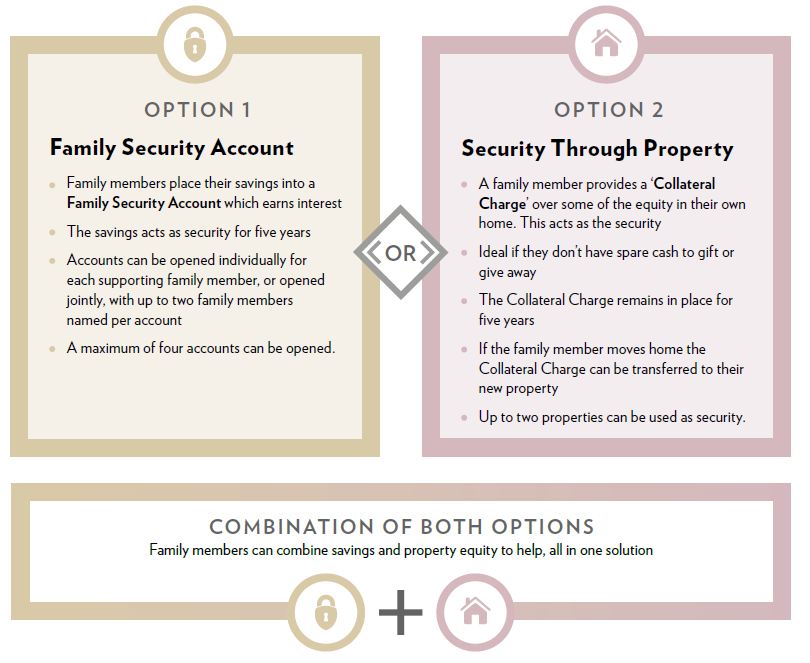

Ways to provide security

Family members can help in one or both of the following ways:

- Savings as security: Family members deposit funds into our Family Security Account and earn interest

- Property as security: Family members provide a Collateral Charge over some of the value in their property

The total security (plus any buyer deposit, if there is one) must equal 20% of the property value.

How long is security needed

Security remains in place for the duration of the five year fixed rate mortgage

By offering security for the mortgage the family member is responsible for making up any shortfall if the property is sold for less than the mortgage value.

Family Mortgage repayment calculator

Calculate the security you and your family will need and your monthly repayments.

How the Family Mortgage security options work

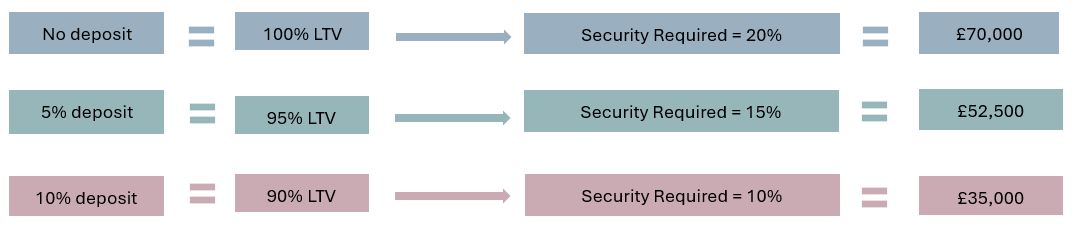

Example: How it adds up

A borrower wants to purchase a £350,000 property. Here are a few security options, including some with and without a deposit.

Loan to Value (LTV) - this is the amount of money you are borrowing compared to the value of the property

Family Mortgage repayment calculator

Calculate the security you and your family will need and what your monthly repayments could be.

Calculate the security needed and your monthly repayments

How to apply

Contact our friendly New Business Team:

Call us on 03330 140144 Ask us to call back Email us Complete our enquiry form

Representative example

A mortgage of £304,688.00 payable over 33 years initially on a fixed rate for 5 years at 5.19% and then on our variable Managed Mortgage Rate, currently 7.54% would require 63 monthly payments of £1,609.09 and 333 monthly payments of £2,031.31 plus one initial interest payment of £1,348.78.

The total amount payable would be £779,247.68 made up of the loan amount plus interest of £474,459.68 and a Mortgage Exit Fee of £100.

The overall cost for comparison is 6.8% APRC representative.

What is a representative example?

This is an illustration of a typical mortgage and its total cost.